Keith is an hourly employee who makes $15 an hour working 40 hours per week, making his gross weekly income $600.

#HOUSEHOLD BUDGET CALCULATOR LIBRE HOW TO#

Here’s how to figure your monthly income as an hourly employee: If you’re an hourly employee, your monthly income isn’t always as consistent as you might like it to be, but with the proper budgeting technique you can definitely nail down a budget that maximizes your monthly income and gets you closer to meeting your greater financial goals. Calculating your monthly income as an hourly employee We’ll show you how to estimate this number in just a moment, but first we’ll go over how hourly employees can calculate monthly income. Now that you have your gross monthly income figured out, you’ll need to deduct taxes and other expenses that may dock your pay-such as medical benefits and contributions to an employer-sponsored retirement plan. To calculate your pre-tax monthly income as a salaried employee, all you need to do is divide your annual salary by 12. One of the benefits of being a salaried employee is knowing exactly what to expect on your paycheck-month in and month out-and this pay structure will serve as an added perk when you’re building a monthly budget. Calculating your monthly income as a salaried employee To find out how much you’re actually earning, you’ll need to do a little bit of simple math-don’t worry, we’ll walk you through the entire way. But calculating your monthly income takes a little bit more effort than glazing over your monthly paychecks. Without figuring out how much money you actually have in your wallet, it’s pretty hard to allocate funds towards saving, spending, and settling outstanding debts. Calculate your monthly income after taxesĪn accurate monthly income is the cornerstone of a successful budget. To get you a step closer to your financial goals, let’s go over how to create a budget step-by-step. With these basic components, you’ll have a foundation for your budget that you can tweak as the months go by and as your financial circumstances change.

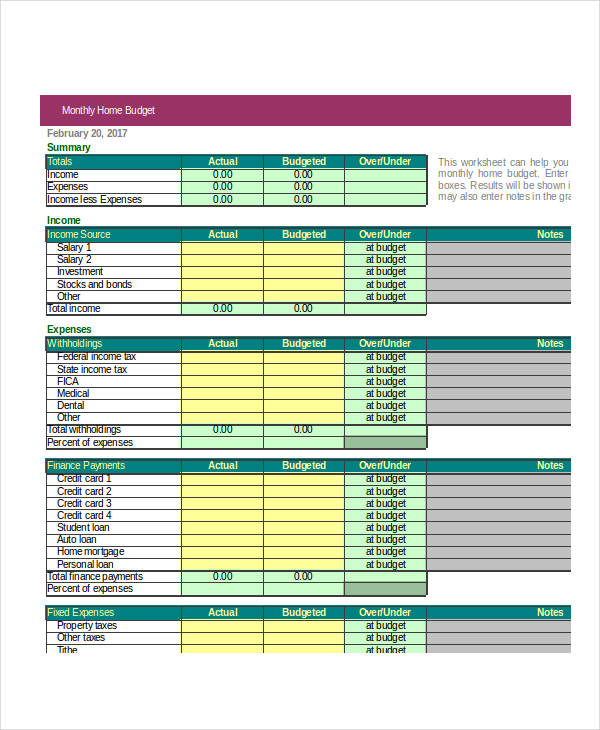

To plan your budget, you’ll need a few key pieces of information. How to Create a Budget : 5 Actionable Steps Need to know how to create a budget ASAP? Read end-to-end for a comprehensive course in Budgeting 101. In our Budgeting 101 guide, we’ll go over some budgeting basics, show you how to create a budget, teach you how to avoid common budget-related mishaps, and ultimately, give you a budget calculator and some budgeting tips to create a budget that’s efficient and functional for your lifestyle. Whether you’re new to managing your own finances, never learned how to budget, or are tired of living paycheck to paycheck, this post is for you. There are many ways you can maintain a budget - with a spreadsheet, paper and pen, or through a budgeting app. Why do I want a budget? says making a budget can help you determine your spending plan and in turn, show you where you should limit your spending and what you can afford to spend more money on. With an understanding of the budget basics, you can track the amount you’re making compared to what you’re spending and saving. Common Budgeting Obstacles and MistakesĪ budget is a financial outline designed to measure and guide your income and expenditures for a certain period of time, such as one month, a quarter, or a year.Selecting a Budgeting Tool That Suits Your Lifestyle.How to Create a Budget: 5 Actionable Steps.A basic budget is all you need to take charge of your money-and help achieve more of your financial dreams. Creating a budget can offer you peace of mind and give you more confidence in managing your finances.

0 kommentar(er)

0 kommentar(er)